As an avid investor and enthusiast of cryptocurrency, I’m thrilled to explore the exhilarating rise of Bitcoin’s fifth wave in the bull market.

This surge is driven by institutional adoption, as more institutions recognize Bitcoin’s potential as a safe-haven investment.

With the United States’ debt-to-GDP ratio reaching unsustainable levels, Bitcoin offers a liberating option for diversifying asset allocation.

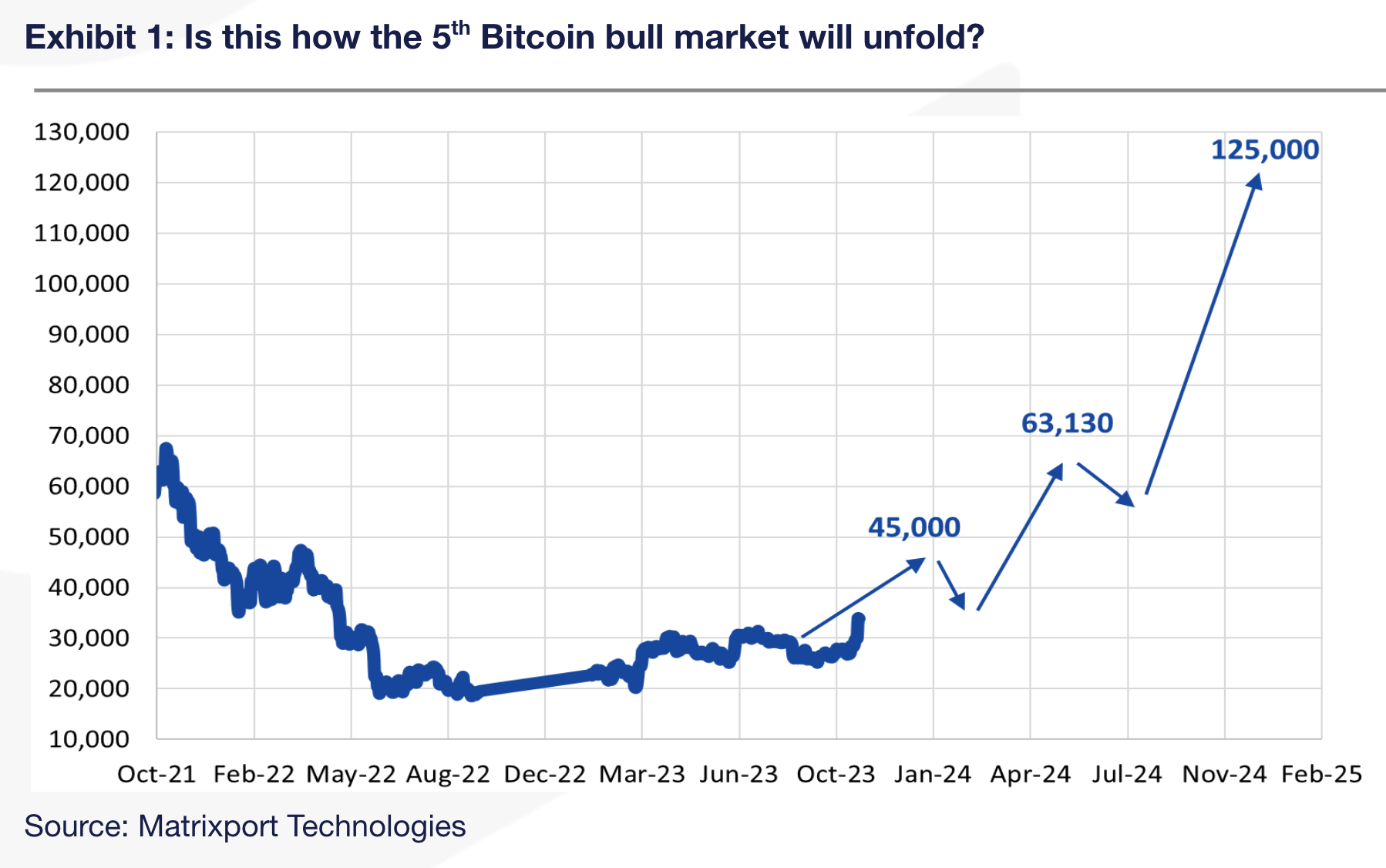

Historical data shows impressive returns during bull market cycles, with predictions of Bitcoin reaching $125,000 by December 2024.

Join me as we delve into the drivers behind this exciting wave and analyze expert recommendations.

Key Takeaways

- Bitcoin has gone through four previous bull market cycles, each driven by a distinct narrative.

- The fifth Bitcoin bull market is primarily driven by expectations of institutional adoption, as institutions consider Bitcoin for diversifying their asset allocation.

- Bitcoin is seen as a safe-haven investment similar to gold and treasury bonds, leading to its surge in value.

- Based on historical performance, Bitcoin could reach $125,000 by December 2024, with an optimal entry point identified as October 2022 when Bitcoin was trading at $17,000.

Background of Bitcoin Bull Market Cycles

In my analysis of Bitcoin bull market cycles, I’ve identified four distinct cycles driven by different narratives.

The first cycle, in 2011, was propelled by Bitcoin’s emergence as a new payment mechanism. During this time, Bitcoin gained attention as a decentralized digital currency.

The second cycle, driven by China, saw Bitcoin recognized as an alternative form of money. China’s interest in Bitcoin led to increased adoption and investment.

The third cycle was marked by the rise of initial coin offerings (ICOs) as a means to establish and fund companies. ICOs gained popularity as a new way to raise capital through cryptocurrency.

Each of these cycles had its unique driving force, shaping the trajectory of Bitcoin’s value and adoption. Understanding these narratives is crucial in comprehending the dynamics of Bitcoin’s bull market cycles.

Distinct Narratives Driving Each Cycle

Throughout Bitcoin’s bull market cycles, distinct narratives have driven each cycle, shaping the trajectory of Bitcoin’s value and adoption.

In the first cycle of 2011, Bitcoin emerged as a new payment mechanism, propelling its value and adoption.

The second cycle was driven by China, where Bitcoin gained recognition as an alternative form of money.

The rise of initial coin offerings (ICOs) marked the third cycle, as a novel means to establish and fund companies.

Now, in the fifth bull market, the narrative revolves around institutional adoption. Bitcoin’s characteristics have attracted institutions seeking to diversify their asset allocation, especially amidst unsustainable levels of the United States debt-to-GDP ratio. Bitcoin is seen as a safe-haven investment, akin to gold and treasury bonds.

This narrative is fueling the current bull market, and investors can expect significant returns in the coming months.

The Rise of Initial Coin Offerings (ICOs)

During the third bull market cycle, Bitcoin experienced the rise of initial coin offerings (ICOs) as a novel method for establishing and funding companies. This phenomenon revolutionized the way startups raised capital by allowing them to issue their own tokens on the blockchain, attracting investors from around the world.

Here are four key points to understand the rise of ICOs:

- ICOs provided an alternative to traditional fundraising methods, democratizing access to investment opportunities.

- The decentralized nature of ICOs eliminated the need for intermediaries, reducing costs and increasing efficiency.

- ICOs allowed companies to tap into a global pool of potential investors, expanding their reach and funding potential.

- However, the lack of regulation and oversight in the ICO space also led to scams and fraudulent activities, highlighting the need for investor protection and regulatory frameworks.

The rise of ICOs represented a significant milestone in the evolution of the cryptocurrency industry, enabling greater innovation and financial inclusion.

Drivers of the Fifth Bitcoin Bull Market

The driving force behind the fifth Bitcoin bull market is institutional adoption. Institutions are increasingly considering Bitcoin as a means to diversify their asset allocation, particularly as the United States debt-to-GDP ratio reaches unsustainable levels. Bitcoin’s characteristics, such as its limited supply and decentralized nature, make it an attractive investment option for institutions seeking a safe-haven asset similar to gold and treasury bonds. To better understand the drivers of the fifth Bitcoin bull market, let’s take a closer look at the table below:

| Drivers of the Fifth Bitcoin Bull Market |

|---|

| Expectations of institutional adoption |

| United States debt-to-GDP ratio |

| Bitcoin as a safe-haven investment |

| Favorable market conditions |

These factors combined have fueled the current bull market, and as momentum continues to build, investors can anticipate further gains in the coming months. It is important to note that the Matrixport report recommended entering the market at the end of October 2022, when Bitcoin was trading at $17,000, aligning with the historical performance of the cryptocurrency and validating the predictions made by the report.

Institutional Adoption as a Catalyst

Institutional adoption serves as a catalyst for the fifth Bitcoin bull market. This wave of growth is driven by several key factors:

- Institutions recognize the potential of Bitcoin for diversification, leading them to consider it as an asset allocation option.

- The current surge in Bitcoin’s value coincides with the United States debt-to-GDP ratio reaching unsustainable levels, further incentivizing institutional adoption.

- Bitcoin is increasingly seen as a safe-haven investment, comparable to traditional safe-haven assets like gold and treasury bonds.

- The institutional adoption of Bitcoin fuels the current bull market, driving its upward trajectory.

This growing acceptance and participation from institutions signify a significant shift in the perception and adoption of Bitcoin, ultimately contributing to its continued growth and potential for liberation.

Bitcoin as a Safe-Haven Investment

As an investor, I recognize the growing acceptance and participation of institutions in Bitcoin, solidifying its position as a safe-haven investment. Bitcoin’s characteristics, such as its limited supply and decentralized nature, have attracted institutions looking to diversify their asset allocation. Its performance during times of economic uncertainty, like the recent global pandemic, has further cemented its reputation as a safe-haven asset. To illustrate this, let’s look at a comparison between Bitcoin, gold, and treasury bonds in terms of their key features:

| Features | Bitcoin | Gold | Treasury Bonds |

|---|---|---|---|

| Limited Supply | Yes | No | No |

| Decentralization | Yes | No | No |

| Portability | High | Low | Low |

| Volatility | High | Low | Low |

| Hedge against Inflation | Yes | Yes | Yes |

As shown in the table, Bitcoin shares some characteristics with gold and treasury bonds, making it an attractive option as a safe-haven investment. Its limited supply, decentralized nature, and ability to hedge against inflation are key factors in its appeal to institutional investors seeking financial liberation.

Commencement and Historical Performance

With the fifth Bitcoin bull market officially commencing on June 22, 2023, investors are eager to examine its historical performance and potential for significant gains. Here is a brief overview of Bitcoin’s past bull market cycles and the drivers behind the current surge:

- Bitcoin has gone through four bull market cycles, each driven by a distinct narrative.

- The first cycle in 2011 was fueled by Bitcoin’s emergence as a new payment mechanism.

- The second cycle saw China’s recognition of Bitcoin as an alternative form of money.

- The third cycle was marked by the rise of initial coin offerings (ICOs) as a means to establish and fund companies.

As for the current bull market, it’s primarily driven by institutional adoption and Bitcoin’s characteristics that make it an attractive asset for diversification. This surge comes at a time when the United States debt-to-GDP ratio is reaching unsustainable levels. Based on historical signals, Bitcoin could potentially reach $125,000 by December 2024.

The optimal entry point to buy Bitcoin was around 14-16 months before the next halving event, with October 2022 being identified as an ideal time when Bitcoin was trading at $17,000. With momentum gaining steam, further gains are anticipated, and investors can expect significant returns in the coming months.

Potential Returns and Optimal Entry Points

I recommend entering the market at the optimal entry point of October 2022 when Bitcoin was trading at just $17,000. This entry point aligns with historical performance and offers the potential for significant returns.

The current bull market is fueled by institutional adoption and favorable market conditions, indicating that Bitcoin’s value will continue to increase. Momentum is gaining steam, further supporting anticipated gains.

The Matrixport report validates this recommendation, as it suggested buying Bitcoin at $17,000, which has proven to be a wise decision.

Momentum and Anticipated Gains

The ongoing surge in the Bitcoin bull market brings with it a sense of momentum and the anticipation of significant gains. As Bitcoin continues its upward trajectory, investors can expect to see further growth and increased returns.

Here are some key factors contributing to this momentum and the anticipated gains:

- Institutional Adoption: The expectations of institutional adoption are driving the current bull market. Bitcoin’s unique characteristics, coupled with the United States debt-to-GDP ratio reaching unsustainable levels, have led institutions to consider it as a safe-haven investment similar to gold and treasury bonds.

- Favorable Market Conditions: The current market conditions, combined with Bitcoin’s institutional adoption, create a favorable environment for the bull market to continue its upward trend. This suggests that Bitcoin’s value will continue to increase, providing investors with significant returns.

- Historical Performance: Based on historical data, when the signal for a new one-year high was triggered, Bitcoin delivered average returns of +310%. This signals the potential for Bitcoin to reach $125,000 by December 2024, reinforcing the anticipated gains.

- Matrixport Report Recommendation: The Matrixport report recommended entering the market at the end of October 2022 when Bitcoin was trading at $17,000. This entry point aligns with the historical performance of Bitcoin and maximizes the potential for gains.

With the current momentum and favorable market conditions, the Bitcoin bull market is poised to deliver substantial gains to investors.

Matrixport Report Recommendation

Continuing from the previous subtopic, it’s important to note the Matrixport report’s recommendation for entering the market at the end of October 2022.

According to the report, buying Bitcoin at that time, when it was trading at $17,000, was considered an ideal entry point for maximizing potential gains.

This recommendation aligns with the historical performance of Bitcoin, as Matrixport’s analysis and prediction have been validated by the current bull market.

It’s crucial for investors who desire liberation to consider the insights provided by the Matrixport report.

By entering the market at the suggested time, individuals can position themselves to benefit from the anticipated gains in the Bitcoin bull market.

The report’s technical and analytical approach aids in making informed decisions and taking advantage of the opportunities presented by the fifth wave.

Conclusion

As a passionate investor and cryptocurrency enthusiast, I couldn’t be more thrilled about the current surge in the Bitcoin bull market.

With institutional adoption on the rise and the United States’ mounting debt, Bitcoin’s appeal as a safe-haven investment is undeniable.

Historical data supports the potential for impressive returns, and experts predict a staggering $125,000 price by December 2024.

With favorable market conditions and momentum building, this fifth wave offers investors an exciting opportunity to reap substantial rewards.

It’s an exhilarating time to be a part of the Bitcoin revolution.

Yesterday News: